How Does Monthly Tax Deduction Work In Malaysia. Web Form EA is a Yearly Remuneration Statement prepared by the company to employees for tax submission.

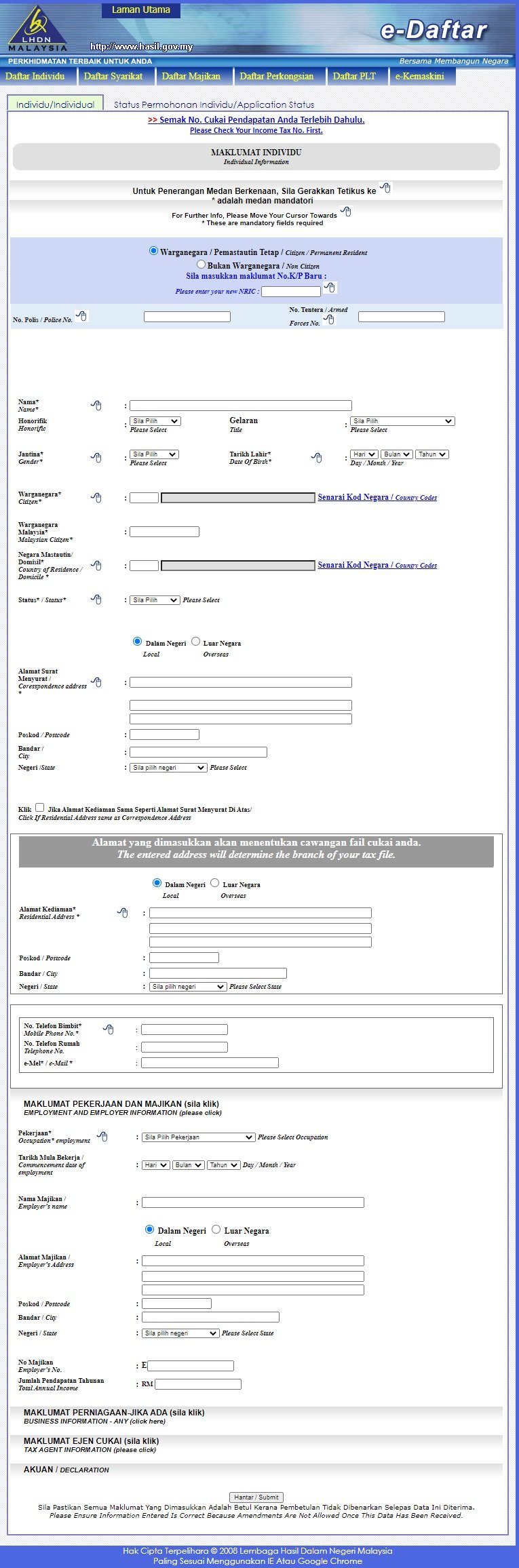

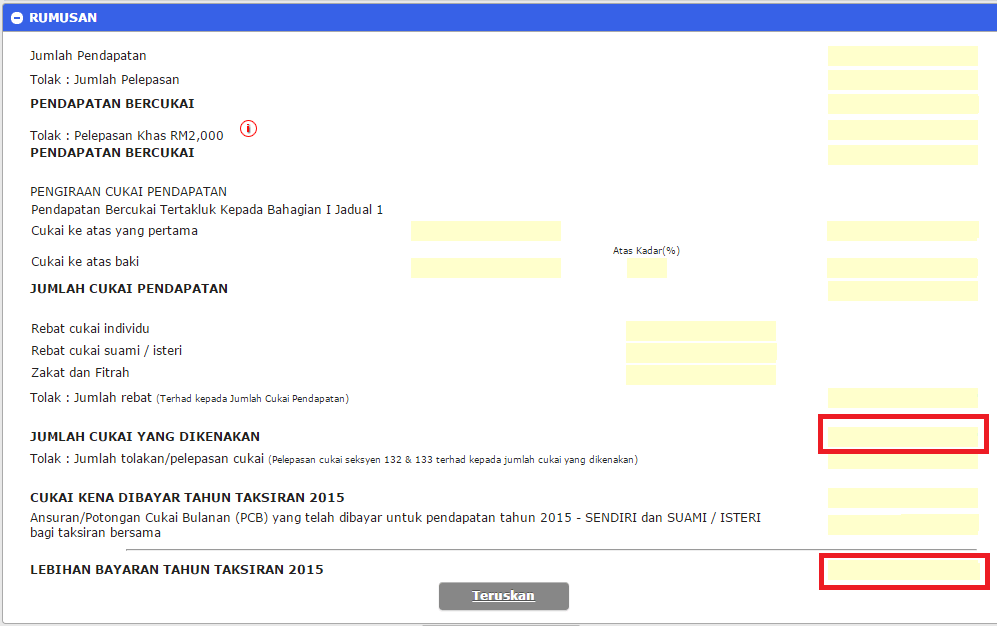

How To Step By Step Income Tax E Filing Guide Imoney

Income tax on certain income they receive from US.

. Tax Rate of Company. Type of taxpayer Form Deadline. Web Introduction Individual Income Tax.

Web Tax Incentives in Malaysia. You cannot pay into the system voluntarily. Heres How A Tax Rebate Can Help You Reduce Your Tax Further.

Amending the Income Tax Return Form. In the case of allowances there is a. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

Under these treaties residents not necessarily citizens of foreign countries may be eligible to be taxed at a. This relief is applicable for Year Assessment 2013 and 2015 only. Web Under a tax treaty foreign country residents receive a reduced tax rate or an exemption from US.

Web If you have never filed your taxes before on e-Filing income tax Malaysia 2022. See Form 1040-ES Estimated Tax for Individuals. According to Section 831A Income Tax Act 1967 that every employer shall for each year prepare and render to his employee statement of remuneration Form EA of that employee on or before the last day of February in the year immediately following the.

This option may vary depending on what type of income tax you are filing and you can refer to this table to help you figure out what to look for. Once the new page has loaded click on the relevant income tax form for the year. Overview The United States has income tax treaties with a number of foreign countries.

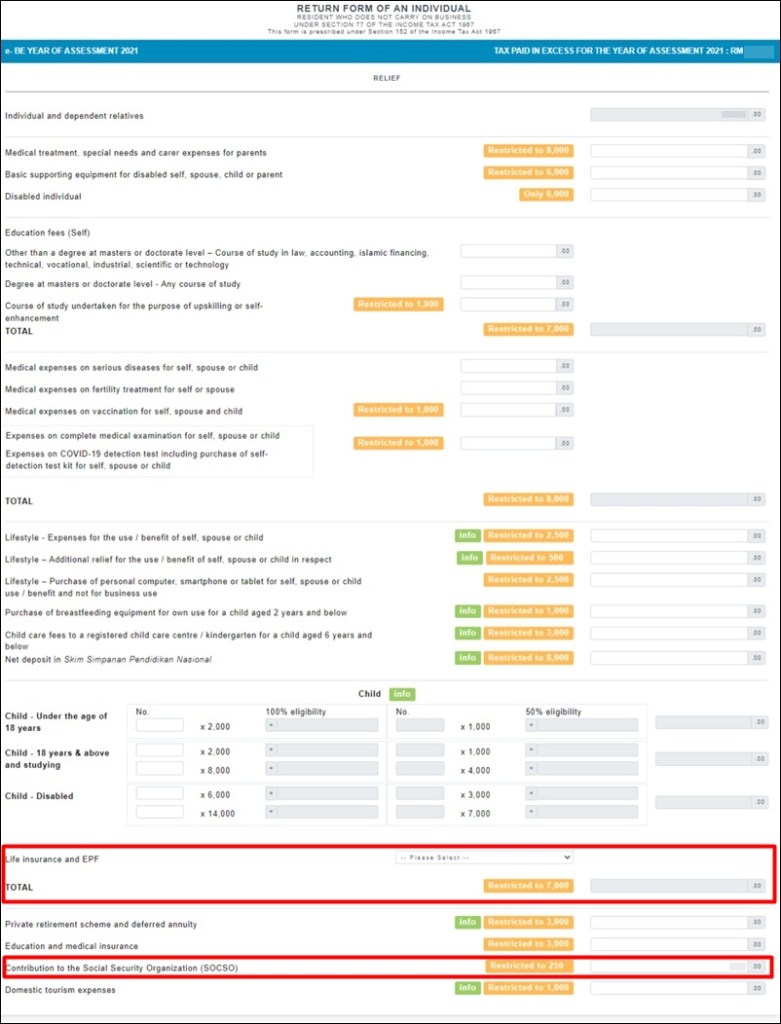

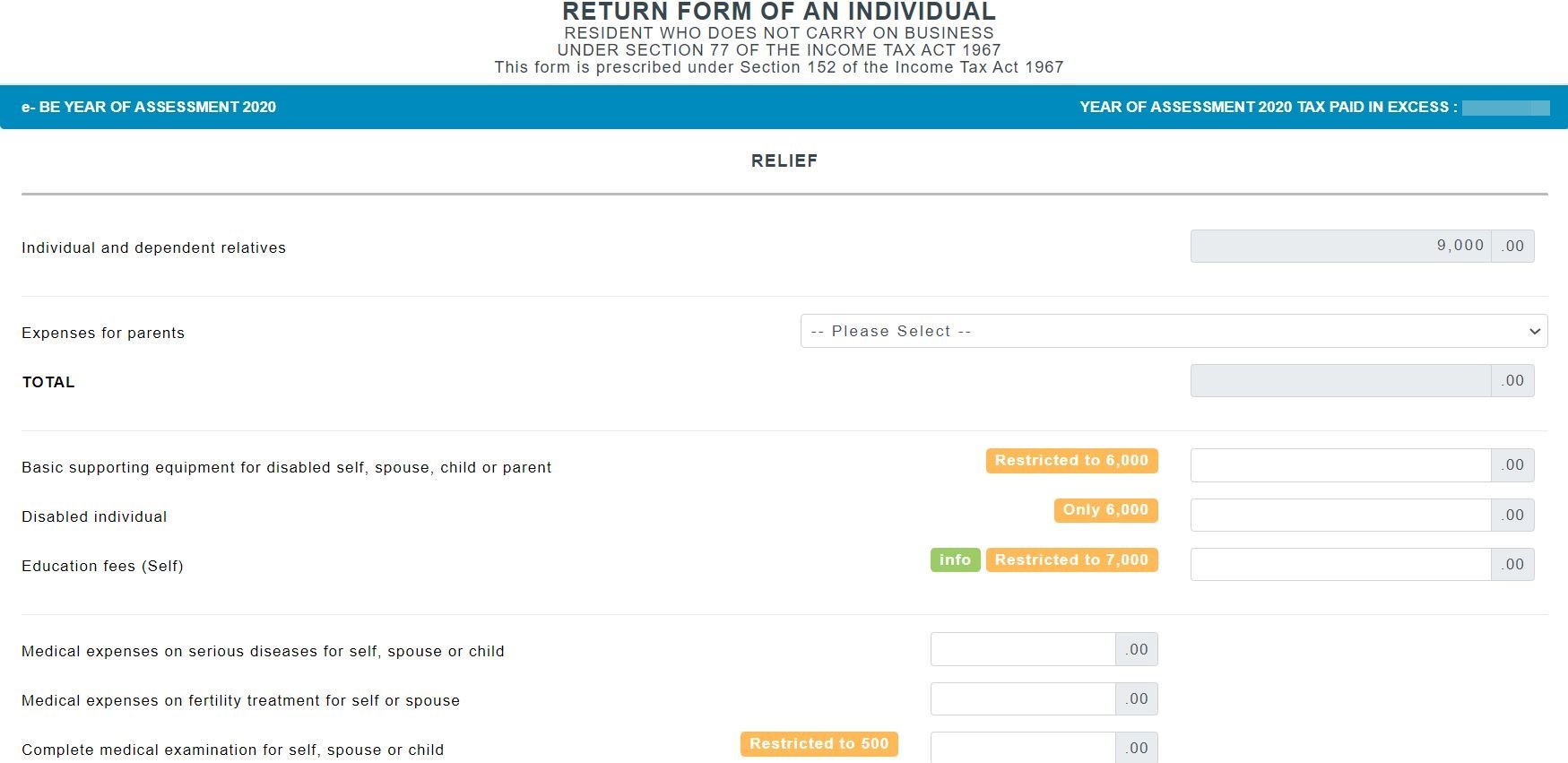

You are exempt from paying social security taxes. Web These Are The Personal Tax Reliefs You Can Claim In Malaysia. Web Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually.

There are different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions. Presumptive Taxation Freelancers can also use the Presumptive Taxation method and escape the tedious task of account bookkeeping when they earn an income less than Rs 50 Lakhs during the given financial year. Web If you fail to pay this tax there would be interest charged on your final tax account under the Section 234 B and 234 C of the Income Tax Act.

Although the income is exempted from tax tax will have to be paid on the dividends paid on tax exempted income. Find Out Which Taxable Income Band You Are In. Web Income tax information for A or G visa holders.

Your foreign mission employer is not required to withhold social security taxes or pay the employer contribution to the social security system.

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

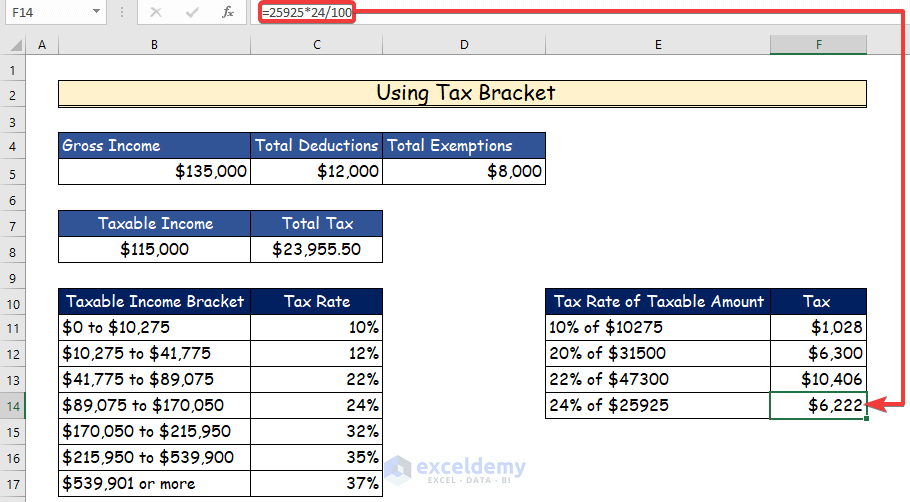

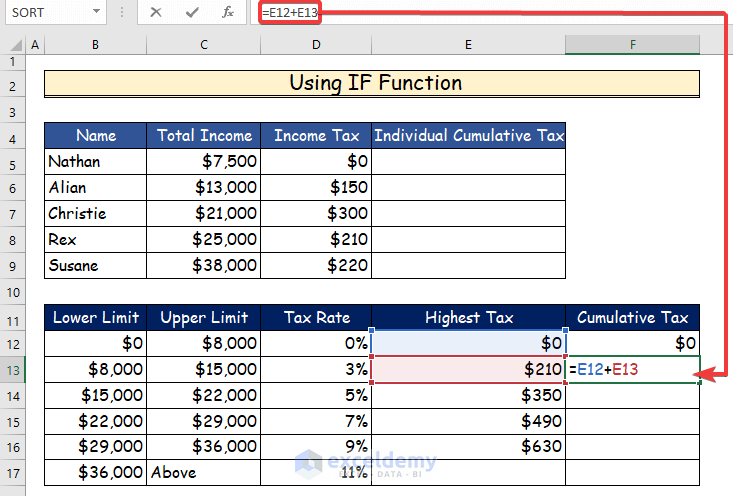

Income Tax Computation In Excel Format 4 Suitable Solutions

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Effects Of Income Tax Changes On Economic Growth

How To Step By Step Income Tax E Filing Guide Imoney

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Malaysia Personal Income Tax Guide 2021 Ya 2020

How To File Your Taxes For The First Time

Income Tax Computation In Excel Format 4 Suitable Solutions

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Malaysia Personal Income Tax Guide 2021 Ya 2020

How To Step By Step Income Tax E Filing Guide Imoney

Sars Income Tax Form Download Ten Latest Tips You Can Learn When Attending Sars Income Tax F Tax Forms Income Tax Income

How To File Your Taxes If You Changed Or Lost Your Job Last Year